stamp duty calculation 2019

Home mover stamp duty rates. Each state or territory uses different formulas to calculate it.

Online Stamp Duty Calculator Check Latest Oct 2022 Rates Here

Primary Residence Investment 2 First Home Buyer.

. For the first RM100000 1. So for example if you buy. Stamp Duty for a house value RM300000 is RM5000.

NSDL shall not be held responsible. ACT Revenue Office For example on a 600000 property purchase in the ACT youd fall within the 500001 to. Current Rates of Stamp Duty from 23rd September 2022 Below are the current rates of Stamp Duty for property purchases in England and Wales.

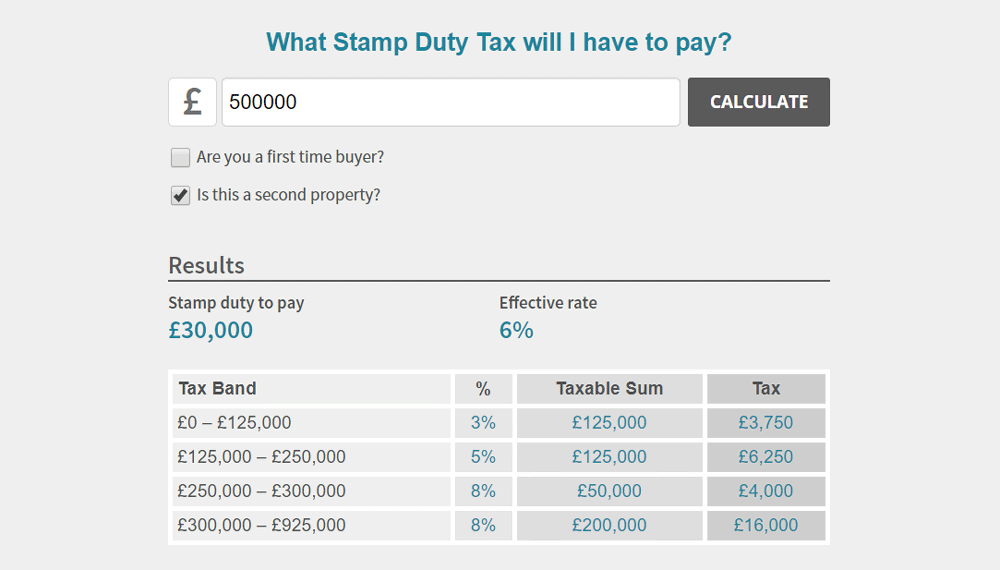

When purchasing an additional property the stamp duty rate of 3 will be payable for properties priced between 40001 and 125000. It is advised that for payment of stamp duty the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc. What is Stamp Duty.

Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments. If you are in. The standard rates are as follows.

The current SDLT threshold for residential properties is 250000. How to calculate property value for stamp duty. Our Stamp duty calculator below shows you just how much youll need to pay.

ACT stamp duty general rate from 1 July 2019. Stamp Duty Calculator Property Value StateTerritory Click Calculate every time you update the options. To calculate property value for stamp duty payment you need to factor in the circle rate ready reckoner rate guidance value.

The stamp duty transfer rates. Motor vehicle registrations and transfers insurance policies mortgages the sale and. So the higher the property value the more expensive the stamp duty will be.

Updated July 9th 2020 0-500000 0 tax 500001 - 925000 8 tax 925001 - 15m 13 tax 15m 15 tax These rates apply only to the. Stamp Duty is a tax paid to government when buying a new home. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan.

RM100000 x 1 RM1000 From RM100001 to. The threshold for non-residential. There were different thresholds and rates for residential properties before 23 September 2022.

Stamp duty is generally calculated on the market value of the property. First-time buyers pay no SDLT. Plus read our full guide for exactly how stamp duty works in different parts of the UK and when you.

Exemptions and concessions are also. You usually pay an extra 3 on top of the. Stamp Duty is charged at a different rate for each part of a propertys value that falls within certain bands.

The additional property rates apply where after the purchase of a residential property for 40000 or more it is not the. The property Purchase Price is RM300000. When you buy a property youre planning to live in and youve owned a home before youll pay the following rates on each portion of the property.

You can calculate how much Stamp Duty youll have to pay here using our calculator. Stamp duty tax is one of the main revenue streams for the state or territory governments. In England or Northern Ireland you pay Stamp Duty Land Tax SDLT while in Scotland you pay Land and Buildings Transaction Tax LBTT and in Wales you will pay Land Transaction Tax.

Here are the rates of SDLT and bands in 2019. Stamp duty or transfer duty is a tax imposed by state and territory governments on transactions such as.

State Wise Stamp Duty In India

Free Stamp Duty Calculator In Excel Youpresent

Rental Stamp Duty In Singapore How Much Is It Property Blog Singapore Stacked Homes

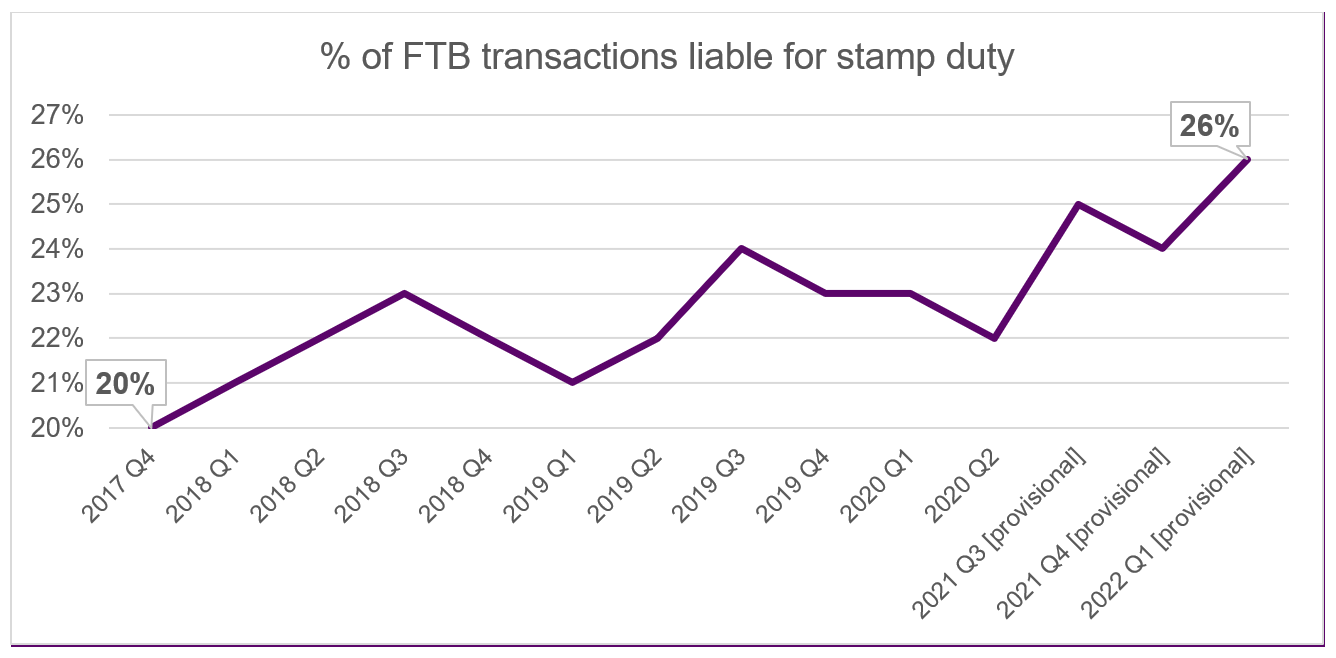

Double Whammy For First Time Buyers As 1 In 4 Pay Stamp Duty Alongside Soaring House Prices Homeowners Alliance

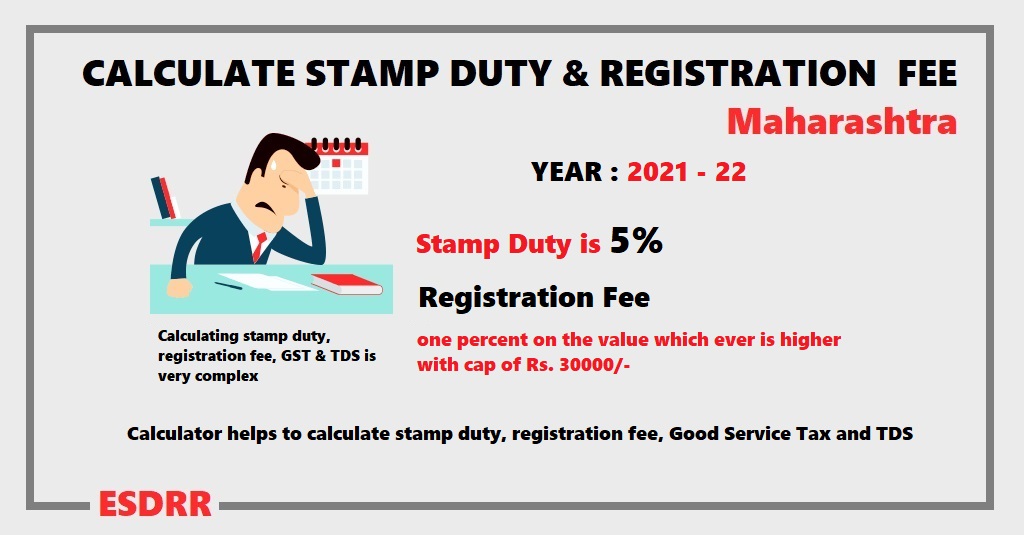

Stamp Duty And Registration Fee Calculator Mahrashtra

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Your Guide To Stamp Duty And Registration Charges Roofandfloor Blog

How Do I Calculate Buyer Stamp Duty Propertywiki

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

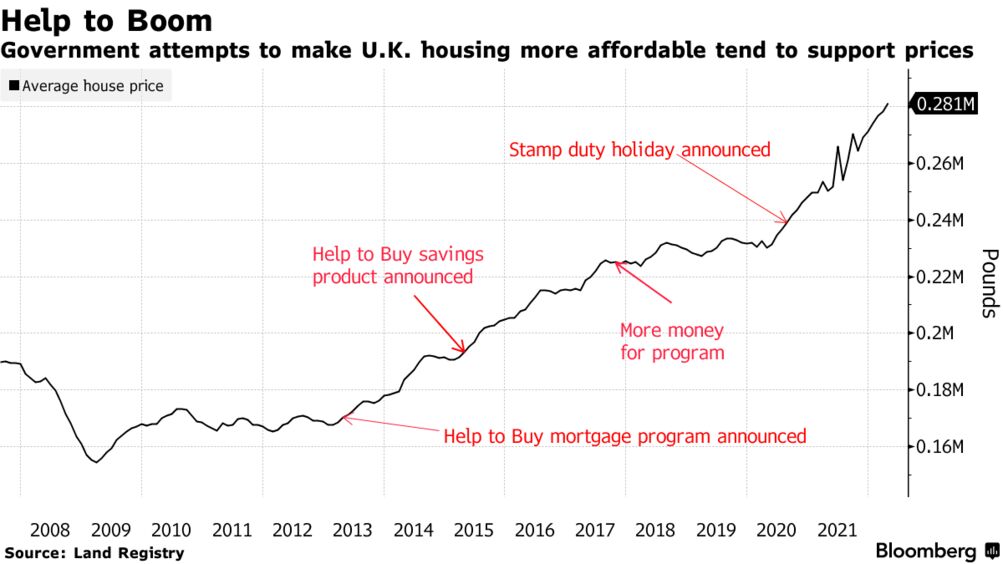

Liz Truss Plans To Cut Uk Stamp Duty Tax The Times Reports Bloomberg

What Is A Stamp Duty How To Calculate Stamp Duty Online

贷款合同的印花税怎么算 How To Calculate Loan Agreement Stamp Duty In Malaysia 2019 Youtube

Stamp Duty Legal Fees New Property Board

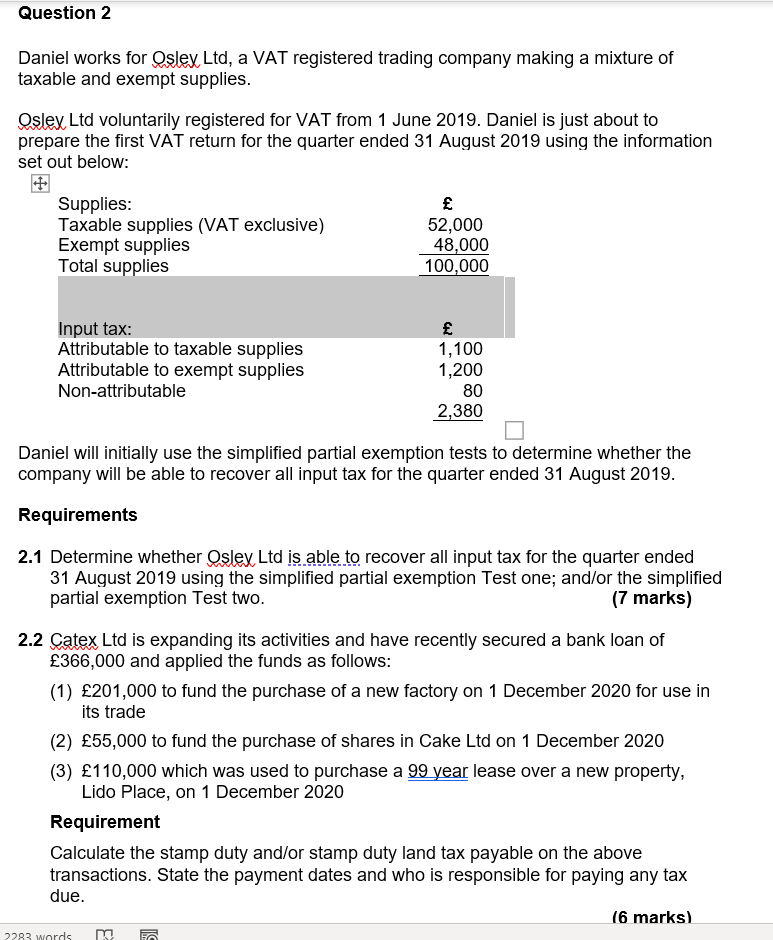

Solved Question 2 Daniel Works For Oslex Ltd A Vat Chegg Com

Github Davidwillprice Stamp Duty Calculator Calculator For Stamp Duty Tax When Buying A Property In The Uk

Stamp Duty Legal Fees New Property Board

Stamp Duty Bombay Hc Rules Stamp Duty Cannot Be Charged For Past Transactions Housing News

How To Register Rent Agreement Pay Stamp Duty Online In Maharashtra

0 Response to "stamp duty calculation 2019"

Post a Comment